income tax calculator philippines

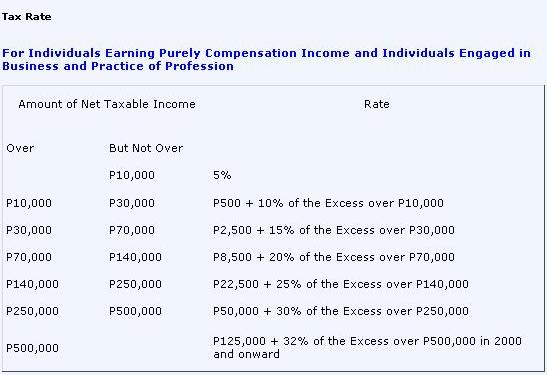

Income tax for Philippines is the individual income tax consists of taxes on compensation income from employment business income and passive. Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens.

How To Calculate Income Tax In Excel

Income tax for Philippines is the individual income tax consists of taxes on compensation income from employment business income and passive income interests dividends.

. There are now different online tax calculators in the Philippines. The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2023 and is a great calculator for working out your income tax and salary after tax based on a. Philippines Annual Salary After Tax Calculator 2022.

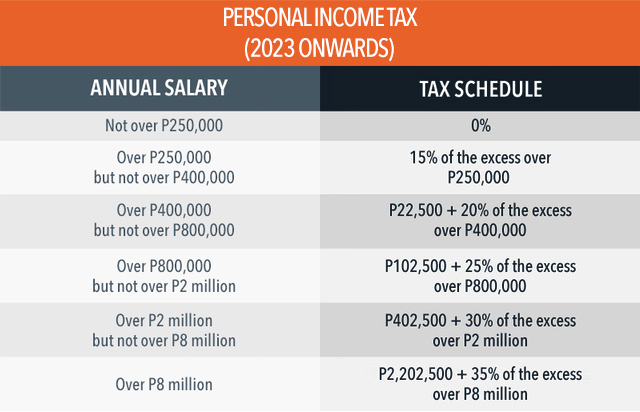

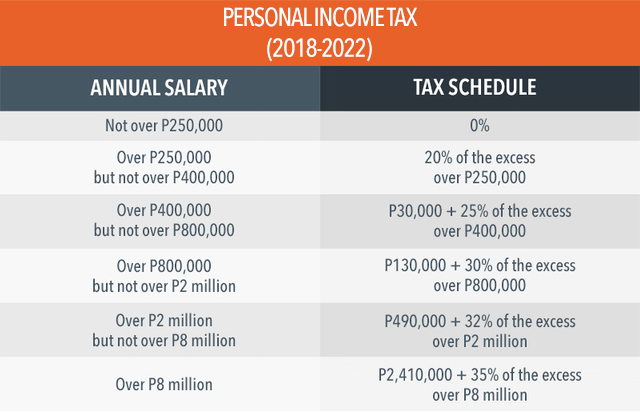

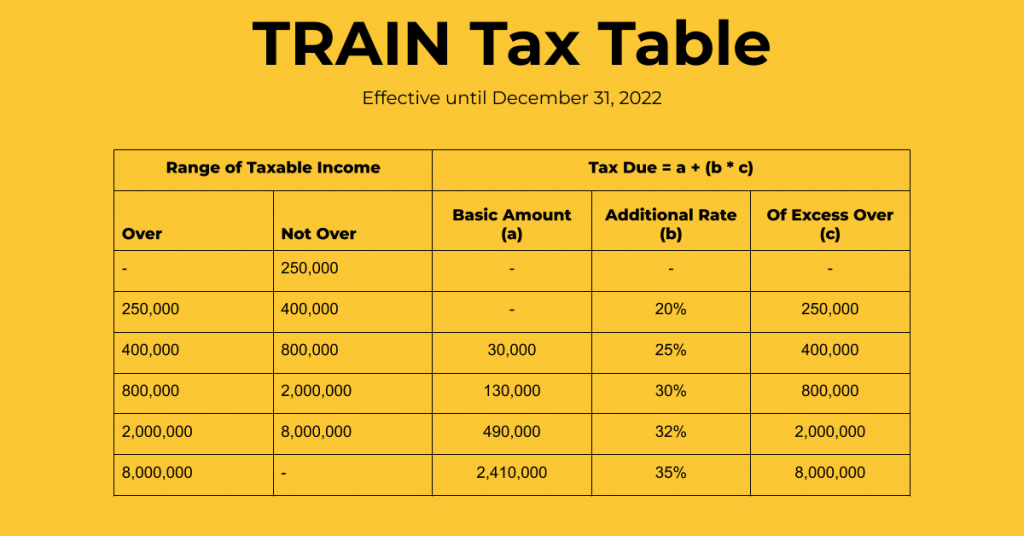

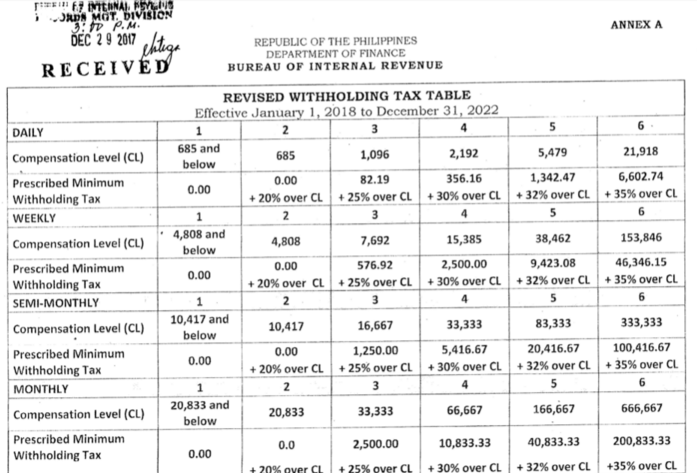

Tax computation in the Philippines changed. Income Tax Rates and Thresholds Annual Tax Rate. Compute for the Income Tax.

Salary and allowances of husband arising from employment. This tool is built so more Filipinos are. Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor.

Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. The Monthly Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working. The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out.

Income Tax Calculator Philippines Who are required to file income tax returns. Philippines Income Tax Calculator. Philippines Residents Income Tax Tables in 2023.

Income tax rates vary depending on an individuals taxable income but in general residents of the Philippines must pay taxes on their worldwide income at a rate of 30. Good thing that there are online tax calculators available in the Philippines to make everything easier for you. You must always be sure to go with the best efficient updated and legitimate online tax calculator program.

Philippine Public Finance and Related. Tax Calculator Philippines is an online calculator you can use to easily compute your income tax and other miscellaneous expenses that comes with it. Philippines Monthly Salary After Tax Calculator 2022.

Salary of PHP 652000 living allowances of PHP 100000 and housing benefits 100 of PHP 300000. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. Accordingly the withholding tax.

Tax Calculator Compute Your New Income Tax

2022 Bir Train Withholding Tax Calculator Tax Tables

How To Calculate Income Tax In Excel

Tax Calculator Compute Your New Income Tax

Tax Calculator Philippines 2022

How To Calculate Income Tax In Excel

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Foreigner S Income Tax In China China Admissions

Taxable Income Formula Examples How To Calculate Taxable Income

How To File Your Annual Itr 1701 1701a 1700 Updated For 2021

Tax Calculator Compute Your New Income Tax

Provision For Income Tax Definition Formula Calculation Examples

Tax Calculator Compute Your New Income Tax

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

2022 Bir Train Withholding Tax Calculator Calculator

How To Compute Income Tax In The Philippines Single Proprietorship Business Tips Philippines

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates